The Consumer Financial Protection Bureau (CFPB) revealed that more than one in four Americans who were contacted by debt collectors felt threatened by the behavior of the creditor or collector.

Debt collection harassment is a troubling reality for many individuals facing financial difficulties. While debt collection is a legal process, some collectors cross the line with harassment, employing aggressive, unethical, and illegal tactics to recover debts. The Fair Debt Collection Practices Act (FDCPA), enforced by the Federal Trade Commission (FTC) and the CFPB, prohibits debt collectors from using harassing, oppressive, or abusive conduct. Understanding your rights and knowing how to respond to these practices is important for protecting yourself. Let’s check out the different ways debt collectors can harass you and figure out how to handle them.

Overview of Debt Collection Harassment and Consumer RightsDebt collection harassment refers to illegal and unethical methods used by collectors to recover money. This includes repeated calls outside allowed hours, threats of arrest or harm, use of abusive language, and false claims about debt amounts or legal authority. Collectors cannot impersonate law enforcement, disclose debts to third parties, or add unauthorized fees. The FDCPA protects consumers by granting rights to dispute debts and seek damages. Victims should document harassment, send cease and desist notices, file complaints, and consider legal action. |

Understanding Debt Collection Harassment Types

1. Excessive Contact:

Debt collectors may repeatedly call, email, or send letters to you, usually at inconvenient morning or night times, like before 8 a.m. or after 9 p.m. They are not allowed to call you at work if you forbid it in writing.

2. Threats and Intimidation

Some debt collectors may use threats and intimidation, such as threatening physical harm, arrest, legal action, wage garnishment, using obscene, profane, or abusive language, or seizing your property without any legal right or intention to do so.

3. False Statements and Misrepresentation

Debt collectors may lie or misrepresent information to deceive you. This can include lying about the amount you owe, who they are, or the legal status of the debt. They even falsely claim to be lawyers or law enforcement officers to scare you.

| Do you Know? Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request written verification of the debt. |

4. Public Disclosure of Debt

This happens when debt collectors disclose your debt to unauthorized third parties, like friends, family, employers, or neighbors, or publish your name or address on a public “bad debt” list, violating your privacy.

5. Unfair Practices

Adding unauthorized fees or charges to the debt is an unfair practice. Additionally, contacting you at your workplace despite a request not to do so is another unfair and harassing tactic.

6. Harassment through Social Media

This can include posting public messages about the debt or sending private messages in a harassing manner.

Rights of Debtors Against Debt Collectors

Under the Fair Debt Collection Practices Act (FDCPA) and Consumer Financial Protection Bureau (CFPB), debtors have several rights to protect themselves from abusive and unfair practices by debt collectors.

- The number of times a creditor will call you is specified in the 7-7 rule. It defines that a debt collector can contact a debtor no more than seven times within a seven-day period.

- Once a debtor receives a validation notice from a debt collector, they have 30 days to challenge or dispute the debt.

- Collectors cannot send fake legal forms or falsely say that non-payment will result in arrest or property seizure unless it’s legal and they intend to pursue that route.

- Debt collectors cannot publish a list of debtors except for providing credit information to a credit bureau for a credit report.

- Debtors have the right to sue debt collectors for violations of the FDCPA, which may result in actual damages, statutory damages, legal costs, and attorney’s fees.

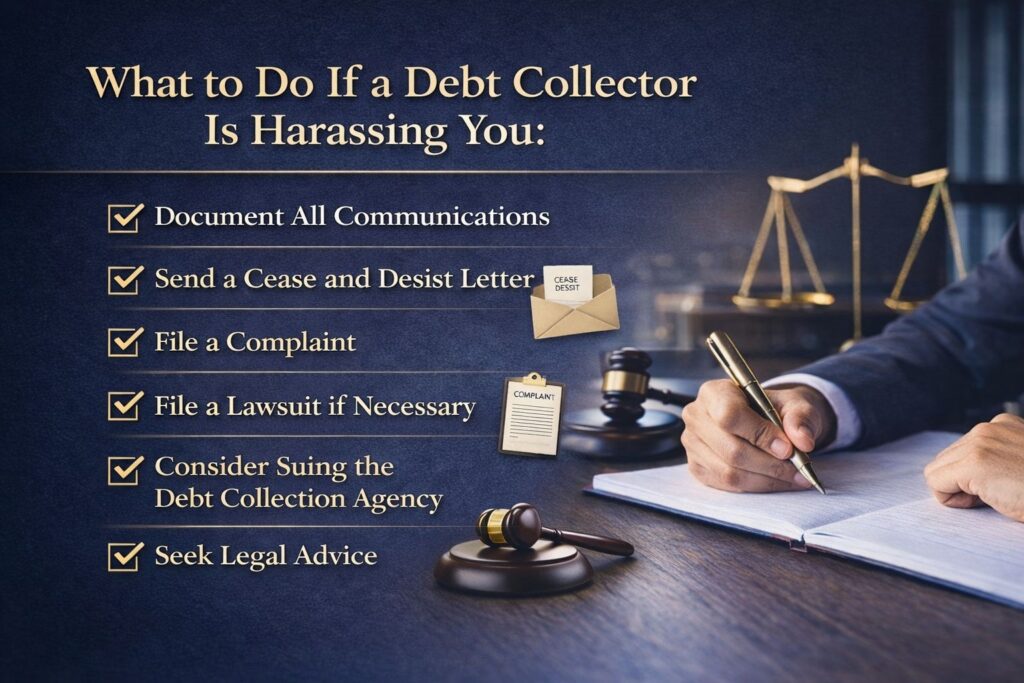

Steps to Take When Harassed By a Debt Collector

Here’s a detailed guide on what to do if you experience debt harassment from a debt collector:

1. Document All Communications

- Keep detailed records of every interaction with the debt collector, including dates, times, names of individuals you spoke with, and the content of the conversations or messages.

- Save copies of all correspondence, including letters, emails, and voicemails.

- Record any instances of harassment, such as threats, obscene language, or repeated calls at inconvenient times.

2. Send a Cease and Desist Letter

To stop the debt collector from contacting you, send a formal cease and desist letter. This letter should state that you request no further communication from them except for legal notices such as a lawsuit or judgment. You can send the letter via certified mail with a return receipt requested to confirm that the debt collector has received your request to cease communication.

| The report on a national survey of consumer experiences with debt collectors highlights that more than 40 % of individuals who were contacted regarding debt in collections asked the creditor or collector to cease communication with them. |

3. File a Complaint

If the debt collector continues to harass you after you’ve sent a cease and desist letter or violates the FDCPA, file a complaint online with the following agencies:

- Consumer Financial Protection Bureau (CFPB)

- Federal Trade Commission

- Your State Attorney General

Remember to include the following in your complaint:

- Collection agency’s name and address

- Name of the original creditor

- Dates and times of all communications

- Names of any witnesses

- Copies of any other material, like written communications, tapes of conversations, your creditor harassment log

4. File a Lawsuit if Necessary

Consider legal action if a debt collector causes significant harm or violates your rights. You can take action for a specific amount of damages or file a claim in small claims court. For more serious violations or if you seek substantial damages, you may need to file a lawsuit in federal court.

5. Consider Suing the Debt Collection Agency

In severe cases of harassment, you might consider suing the debt collection agency.

- Time Limit: You have one year from the date of the law violation to sue for damages in state or federal court.

- Potential Awards: If the debt collector violated the law, you can be awarded up to $1,000 plus attorney fees and recover damages.

- Debt Validity: Winning a lawsuit against the debt collector does not eliminate the debt; you still owe the debt.

- Bona Fide Error: If the debt collector can prove that the violation was unintentional and resulted from a “bona fide error” despite procedures to avoid such errors, they may not be held liable.

6. Seek Legal Advice

If you are unsure about your rights, seeking advice from a lawyer who specializes in debt collection matters is recommended. A debt collection harassment attorney can help you –

- Understand your legal options

- Represent you in disputes

- Provide guidance on potential legal action.

For expert advice and effective strategies against debt collection harassment, contact Zemel Law LLC today. Additionally, if you have issues with a credit report, our mixed credit report attorneys can help you rectify and protect your credit.

Wrapping Up:

Debt collection harassment can greatly impact your mental health, but with the right knowledge and guidance on the laws that protect you, such as the Fair Debt Collection Practices Act (FDCPA), you can put an end to the harassment. To avoid future debt collection harassment, regularly monitor your credit report and address any differences or errors to prevent debt collectors from wrongfully contacting you about debts that are not yours or have already been settled.

FAQ’s

Q1. Can a debt collector call me at work?

A debt collector can call you at work unless they know or have reason to know that your employer prohibits such calls. If you tell them (verbally or in writing) to stop calling you at work, they must stop.

Q2. What is the “11 words” loophole in debt collection?

This often refers to the “Mini-Miranda” warning. When a debt collector contacts you, they must say: “This is an attempt to collect a debt and any information obtained will be used for that purpose.” If they fail to say this in the initial communication (and subsequent communications), they may be violating the FDCPA.

Q3. Can a debt collector sue me after 7 years?

It depends on the “statute of limitations” for debt in your state, which typically ranges from 3 to 6 years, though some are longer. After this period, the debt is “time-barred,” meaning they cannot legally sue you to collect it. However, they may still try to contact you to pay it voluntarily.

Q4. Does a cease and desist letter stop the debt?

No. A cease and desist letter only stops the communication from the collection agency. It does not eliminate the debt. The creditor can still take legal action against you, such as filing a lawsuit to obtain a judgment.

Q5. How do I prove harassment in court?

Documentation is key. Your “harassment log” (dates, times, content of calls), saved voicemails, copies of letters, and witness testimony are your primary tools for proving violations of the FDCPA.