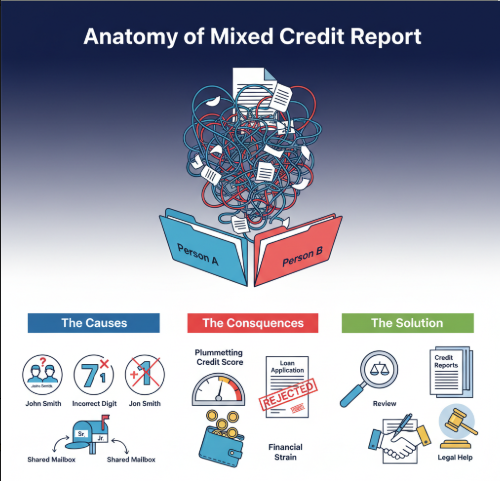

Many people are unaware of a critical issue that can severely impact their creditworthiness: a mixed credit report. According to a Federal Trade Commission study “1-in-5 consumers had errors in at least one of their three credit reports, and 1-in-20 had errors that affected the likelihood of receiving credit or affected the credit rate.” These errors can lead to confusion and damage your credit profile, further affecting your creditworthiness. So, it is crucial to understand how these issues arise and their impact. In this blog post, we’ll explore what a mixed credit report is, how it can happen, and the potential effects on your credit reputation.

Overview of Mixed Credit Reports and How to Resolve ThemA mixed credit report can severely impact your financial health, often involving another individual’s debt mistakenly listed under your credit profile. This issue may arise from errors such as similar names or Social Security numbers. Key signs include unexplained changes to your credit score, unfamiliar accounts, or creditors contacting you about debts you don’t owe. Addressing this requires promptly disputing inaccuracies with credit bureaus and, if necessary, seeking legal assistance to protect your financial reputation. Understanding how to identify and resolve these errors is essential for safeguarding your credit and ensuring your financial records accurately reflect your own credit history. |

What is a Mixed Credit Report?

A mixed credit file occurs when credit information from different individuals is mistakenly combined into one report, often due to similar personal details like names or Social Security numbers. Even a credit report’s wrong address or birth date can get consumers into trouble. This can lead to incorrect credit scores, impacting loan approvals and interest rates. Other mistakes can be particularly serious, like when fraudulent accounts are listed in a report as a result of identity theft. If you suspect a mixed credit report error, a mixed credit report attorney can help identify and resolve these problems. So, let’s look at the signs indicating your account has a mixed credit report error.

Signs Indicating Your Account Has Mixed Credit Report Error

1. Unfamiliar Accounts on Your Credit Report

One of the most obvious signs of a mixed credit file is the appearance of unfamiliar accounts. If you discover accounts on your credit report that you don’t recognize, it could be because your credit file has been merged with someone else’s. For instance:

- Loans or Credit Cards: Accounts that you did not open, such as loans or credit cards, might appear.

- Account Activity: Transactions or account balances that you did not authorize might be visible on your report.

2. Incorrect Personal Information

- Name Variations: Different variations of your name, the appearance of someone else’s name, or a wrong middle name.

- Incorrect Social Security Number: If your report contains a Social Security number that is not yours or closely matches someone else’s, it may indicate that your information has been combined with another person’s.

- Wrong Address: Addresses that you have never lived at or that belong to someone else can be a sign of a credit mix.

- Mismatched Identification Information: It lists incorrect or outdated identification details, such as an incorrect date of birth.

3. Unfamiliar Hard Inquiries

- Unexpected Inquiries: Inquiries from companies where you did not apply for credit may indicate that another person’s credit activity is showing up on your report.

- Frequent Inquiries: A high number of hard inquiries within a short period, especially from unknown or unrelated entities.

4. Discrepancies in Credit Accounts

- Account Ownership: Seeing accounts listed under your name but with different ownership details, such as accounts that list you as a primary account holder when you are actually an authorized user.

- Incorrect Account Details: Incorrect balances, dates of missed payments, or account statuses (e.g., showing an account as open when it should be closed).

- Account History: Accounts with histories that do not match your own, such as payments that are not your responsibility or defaulted accounts.

5. Other Signs May Include

- Errors in public records, such as mistaken criminal records or incorrect legal judgments.

- Receiving debt collection notices or calls for debts that aren’t yours.

- Denied credit or a loan without any clear reason.

- Seeing job titles, employers, or employment periods on your credit report that don’t match your actual work history could indicate a credit mix.

- Your credit score drops significantly due to late payments or high credit utilization that doesn’t belong to you.

How Can Mixed Credit Report Impact Your Credit Score?

Here’s a detailed look at how a mixed credit report can mess with your credit score:

1. Your credit history is suddenly longer or shorter

You’ve been building your credit for years, and suddenly, your report includes accounts that have been open much longer or shorter than your actual accounts. This mix-up can either artificially inflate your score (by making it look like you have a longer credit history) or hurt it (by making your credit history seem newer and less established).

2. You’re denied credit you should qualify for

When you apply for a credit card, everything on your end looks good. But if someone else’s negative information, such as high credit card balances or collections, appears on your report, it seems like you’re using a large percentage of your available credit, which can lower your score. High credit utilization is a major factor in credit scoring and makes the lender perceive you as a higher risk than you actually are.

3. Your interest rates go up Unexpectedly

If you have a credit mix with someone with a history of missed payments or high debt, lenders might raise your interest rates even if you’ve made all your payments on time.

4. You’re flagged for fraud you didn’t commit:

Your accounts can be frozen or closed if the other person’s report has a history of identity theft or fraud. When this information ends up on your credit report, it might look like you’re the one involved in suspicious activities.

5. You’re caught in legal trouble that isn’t yours:

If someone you’re associated with has been involved in a debt-related lawsuit and it shows up on your credit report, it may harm your credit score and reputation.

Wrapping Up:

A mixed credit file can have serious financial consequences, potentially derailing your big plans that depend on good credit. The situation can worsen without proper knowledge, making it important to seek legal advice. Zemel Law LLC is the firm you can trust in these situations. Our mixed credit report attorney can provide expert legal advice, help negotiate a settlement, and file a lawsuit on your behalf. If you’ve been a victim of identity theft, our identity theft lawyer is also here to assist you.

FAQ’s:

Q1. Can I fix a mixed credit report myself?

Yes, you can file a dispute with the credit bureaus (Equifax, Experian, and TransUnion). However, mixed files can be complex to untangle, and if the bureaus fail to correct the error, you may need legal assistance.

Q2. How long does it take to fix a mixed file?

Credit bureaus legally have 30 to 45 days to investigate a dispute. However, if they verify the incorrect information as accurate, the process can take much longer and may require litigation.

Q3. Does a mixed credit report mean my identity was stolen?

Not necessarily. While identity theft can cause mixed reports, it often happens due to administrative errors or matching algorithms at the credit bureaus. However, it is vital to check to ensure no fraudulent accounts have been opened.

Q4. Will fixing the report restore my credit score immediately?

Once the erroneous information is removed, your score should recalculate to reflect only your accurate history. This update typically happens within a billing cycle or two after the correction.