“When persistence turns to pestering, it’s time to know your rights.”

The Fair Debt Collection Practices Act (FDCPA) was created to shield consumers from abusive practices by debt collectors. While creditors have a right to pursue unpaid debts, there are strict boundaries that protect consumers from debt collection harassment. A 2020 survey by the Consumer Financial Protection Bureau revealed that 1 in 4 Americans reported feeling threatened by debt collectors. Over 70 million consumers are contacted annually, but many are unaware of their rights.

This blog looks into how and when creditor behavior crosses the line, empowering you to protect yourself with the assistance of a creditor harassment attorney and ensuring debt collection remains fair, not fear-driven.

| Understanding Creditor Harassment and Your FDCPA Rights

The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive debt collection practices. When creditor persistence turns to harassment, through excessive calls, threats, false claims, or disclosing debt, your rights protect you. You can limit contact, dispute or validate debts, stop communications, and seek legal recourse. Engaging a creditor harassment attorney ensures collectors follow the law, safeguards your privacy, and allows you to recover damages for violations, maintaining fair and respectful debt collection. |

Identifying Harassment Under the FDCPA

- Frequent or Repeated Calls: The FDCPA prohibits excessive calls intended to annoy, abuse, or harass. Debt collectors cannot call you repeatedly within a short time frame or use automatic dialing to overwhelm you.

- Calling at Inconvenient Hours: If a debt collector continuously calls you at work or inappropriate hours, except if you have agreed to, it is considered debt collection harassment.

- Threats of Violence or Harm: Any form of intimidation, including threats of violence, harm, or legal actions without basis, violates FDCPA regulations. Collectors cannot use fear tactics to pressure payment.

- Abusive or Profane Language: The use of offensive language, insults, or verbal abuse is a clear violation of the FDCPA. Collectors must maintain professional communication at all times.

- Disclosing Debt to Third Parties: Debt collectors cannot reveal your debt to unauthorized third parties, except your creditor harassment lawyer or spouse. Discussing your debt with others is a form of debt collector harassment and privacy invasion.

- False or Misleading Representations: Misrepresenting the amount owed, falsely claiming to be law enforcement, or threatening legal action that isn’t imminent are tactics that violate the FDCPA.

- Failing to Identify Themselves: Debt collectors must clearly identify themselves and the purpose of their call. Failing to do so or pretending to be someone else, like a government agent, constitutes debt collection harassment under the FDCPA.

- Deceptive Collection Letters: Written communications designed to mislead or frighten consumers, such as sending documents that look like legal forms, also fall under debt harassment as outlined by the FDCPA.

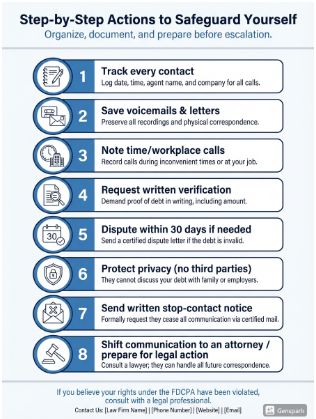

Protect Your Rights Against Debt Collectors

When collection contact starts affecting your day-to-day life, a structured response helps you stay organized, protect your privacy, and be ready to shift communication to legal support if needed.

Know Your Rights | The Fair Debt Collection Practices Act (FDCPA)

Overview of the FDCPA

The Fair Debt Collection Practices Act (FDCPA) is a federal law that sets rules for debt collectors who are trying to collect money on behalf of someone else. The law limits how, when, and how often collectors can contact people about unpaid debts.

If a collector breaks these rules, the person being contacted can take legal action against both the company and the individual collector and possibly win damages and attorney fees owing to debt collector harassment. The Consumer Financial Protection Bureau (CFPB) has a debt collection rule that explains these FDCPA rules in more detail, specifically about how debt collectors are allowed to communicate with people who owe money.

Your Rights Under the FDCPA to Fight Creditor Harassment

- Right to Be Free from Harassment

The FDCPA prohibits debt collectors from engaging in collection harassment. This includes threats, abusive language, excessive phone calls, or any behavior intended to intimidate or annoy. If a collector engages in these tactics, they are violating your rights.

- Right to Limit Contact

You have the right to restrict how and when debt collectors contact you. Collectors cannot call before 8 a.m. or after 9 p.m. without your permission, and they cannot call you at work if your employer disapproves.

- Right to Dispute the Debt

You can dispute any debt you believe is inaccurate within 30 days of receiving a notice. If you dispute the debt, the collector must provide written proof before continuing to contact you. This gives you protection against paying debts you don’t owe.

- Right to Request Debt Validation

You have the right to request that the collector verify the debt. After your request, the collector must send you information about the debt, including the amount owed and the name of the original creditor, before they can continue collection efforts.

- Right to Stop Communication

You can send a written request to the debt collector to stop all communications. Once received, the collector is legally obligated to stop contacting you except to inform you of legal actions or to confirm that collection efforts have ceased.

- Right to Protection of Privacy

Debt collectors cannot share information about your debt with third parties, like your friends, family, or employer. They can only contact your debt collection or Mixed Credit Report Attorney.

- Right to Sue for Violations

If a debt collector violates your FDCPA rights, you have the right to sue them in state or federal court. You can recover damages for debt collection harassment, attorney fees, and statutory damages of up to $1,000, even if you suffered no specific financial loss.

- Right to Accurate Credit Reporting

Debt collectors must report accurate information to credit bureaus. If they fail to update the debt’s status after it’s paid or report incorrect information, you can dispute this and demand corrections.

- Right to Avoid Unfair Collection Practices

The FDCPA protects you from unfair practices, such as charging unauthorized fees, depositing post-dated checks early, or threatening to seize property without proper legal authority. Collectors cannot take actions not permitted by law or your original credit agreement.

- Right to Legal Representation

If you feel overwhelmed by creditor collection harassment, you have the right to hire an attorney. Once you have legal representation, debt collectors must communicate with your lawyer instead of directly contacting you, reducing stress and ensuring your rights are fully protected.

Struggling With Creditor Harassment? Reach Out To A Creditor Harassment Attorney!

A creditor harassment attorney is crucial in protecting you from illegal debt collection practices. If debt collectors are using abusive language, making excessive calls, or threatening you, an attorney can step in to stop these violations of the Fair Debt Collection Practices Act (FDCPA). They will assess whether your rights have been violated and help you take legal action, which can include suing the collectors for damages. An attorney for debt harassment can also communicate with collectors on your behalf, reducing stress and ensuring they follow the law.

If you’re facing creditor harassment, Zemel Law is here to help. We have a highly experienced team of debt collection, mixed credit report, and identity theft attorneys. Contact us today for a free consultation, and let us protect your rights and hold abusive collectors accountable.

FAQ’s

Q1. I’m getting calls all day. What can I do to reduce or control contact?

Set boundaries on when contact is allowed and restrict work calls when your employer disapproves. If you want the contact to end, send a written request to stop communication.

Q2. What exactly should I request if I want the collector to “prove it”?

Request debt validation information, including the amount owed and the name of the original creditor.

Q3. I don’t want my family or employer dragged into this—how do I protect my privacy?

Collectors are not allowed to share debt information with unauthorized third parties; communications are restricted to permitted channels, including your legal representation.

Q4. The caller won’t clearly say who they are or why they’re contacting me. What should happen in a proper call?

They must clearly identify themselves and the purpose of the call; if you have an attorney, they must communicate through your lawyer.

Q5. I’m being intimidated. What’s the cleanest next step if I want it handled without more direct contact?

Hire an attorney so the collector communicates with your lawyer instead of you, and evaluate whether legal action is appropriate.